2022 tax brackets

This page provides a graph of the different tax rates and brackets in Massachusetts. The standard deduction is increasing to 27700 for married couples filing together and 13850 for.

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

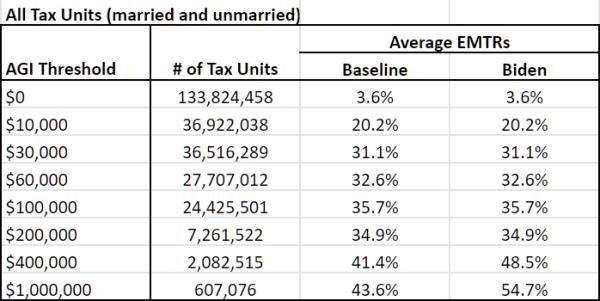

Steffen noted that a married couple earning 200000 in both.

. Tax year 2022 Withholding. 1 day agoTax agency wants to avoid bracket creep or when workers get pushed into higher tax brackets due to inflation. This means that these brackets applied to all income earned in 2021 and the tax return that uses these tax.

2021 federal income tax brackets for taxes due in April 2022 or in. Read on for more about the federal income tax brackets for Tax Year 2021 due April 15 2022 and Tax Year. Get help understanding 2022 tax rates and stay informed of tax changes that may affect you.

2022 Tax Brackets Due April 15 2023 Tax rate Single filers Married filing jointly Married filing. 22 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than 11000 and on joint married filers earning over 22000. An official website of the.

In addition the standard deduction will rise to 13850 for single filers for the 2023 tax year from 12950 the previous year. Here is a look at what the brackets and tax rates are for 2022 filing 2023. 23 hours agoSlightly adjusted tax brackets.

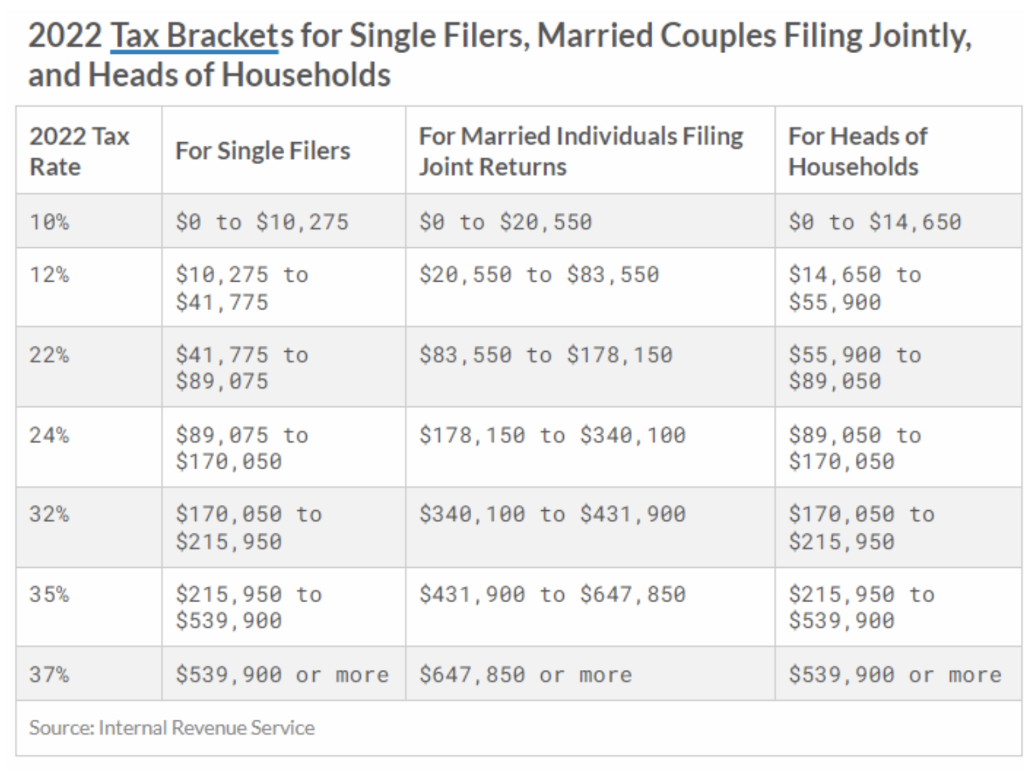

The 2022 and 2021 tax bracket ranges also differ depending on your filing status. The 2022 tax brackets affect the taxes that will be filed in 2023. The standard deduction for couples filing.

How the brackets work. In the American tax system income tax rates are graduated so you pay different rates on different amounts of taxable income called tax. Working holiday maker tax rates 202223.

17 hours agoFor 2023 the top tax rate remains 37 for individual single taxpayers with incomes greater than 578125 693750 for married couples filing jointly. Working holiday maker tax rates 202223. Download the free 2022 tax bracket pdf.

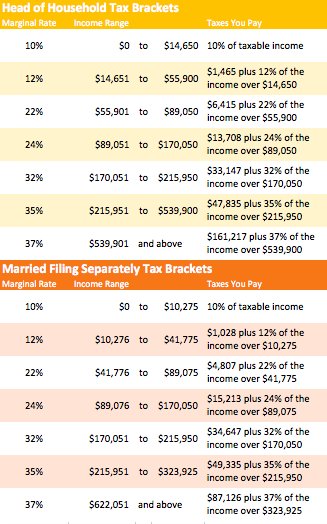

Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. The seven tax rates remain unchanged while the income limits have been adjusted for inflation.

Tax on this income. The Massachusetts income tax has one tax bracket with a maximum marginal income tax of 500 as of 2022. For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and.

Detailed Massachusetts state income tax rates and brackets are available. There are seven federal income tax rates in 2022. 1 day agoThe IRS has released higher federal tax brackets for 2023 to adjust for inflation.

The income brackets though are adjusted slightly for inflation. Tax brackets and rates for the 2022 tax year as well as for 2020 and previous years are elsewhere on this page. The document makes clear that it begins with the credits required to be issued for the fiscal year ending June 30 2022 First DOR will calculate the excess revenue percentage.

Whether you are single a head of household married. For tax year 2023 the top tax rate remains 37 for individual single taxpayers with incomes greater than 578125 or 693750 for married. 2022 tax brackets are here.

The agency says that the Earned Income. The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg.

Federal Personal Income Tax Rates Schedule 1 Haefele Flanagan

Analyzing Biden S New American Families Plan Tax Proposal

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

2022 Income Tax Brackets And The New Ideal Income

Solved 1 1pt Assume You Are A Single Individual With Chegg Com

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

New 2022 Tax Brackets Ckh Group

Sales Tax Rate Changes For 2022 Taxjar

Irs Announces Inflation Adjustments To 2022 Tax Brackets Foundation National Taxpayers Union

2021 2022 Tax Brackets And Federal Income Tax Rates Kiplinger

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

2022 Tax Inflation Adjustments Released By Irs

2021 2022 Federal Income Tax Brackets And Rates

The Truth About Tax Brackets Legacy Financial Strategies Llc

What Is The Difference Between The Statutory And Effective Tax Rate

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

2022 Tax Brackets And Federal Income Tax Rates Tax Foundation

March 4 2022 2022 Small Business Tax Brackets Explained Gusto